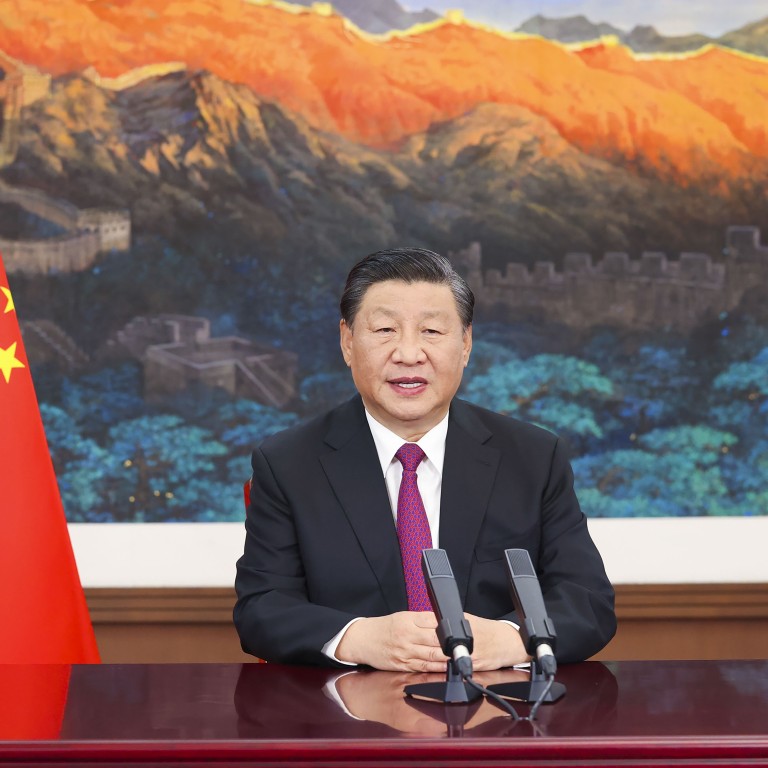

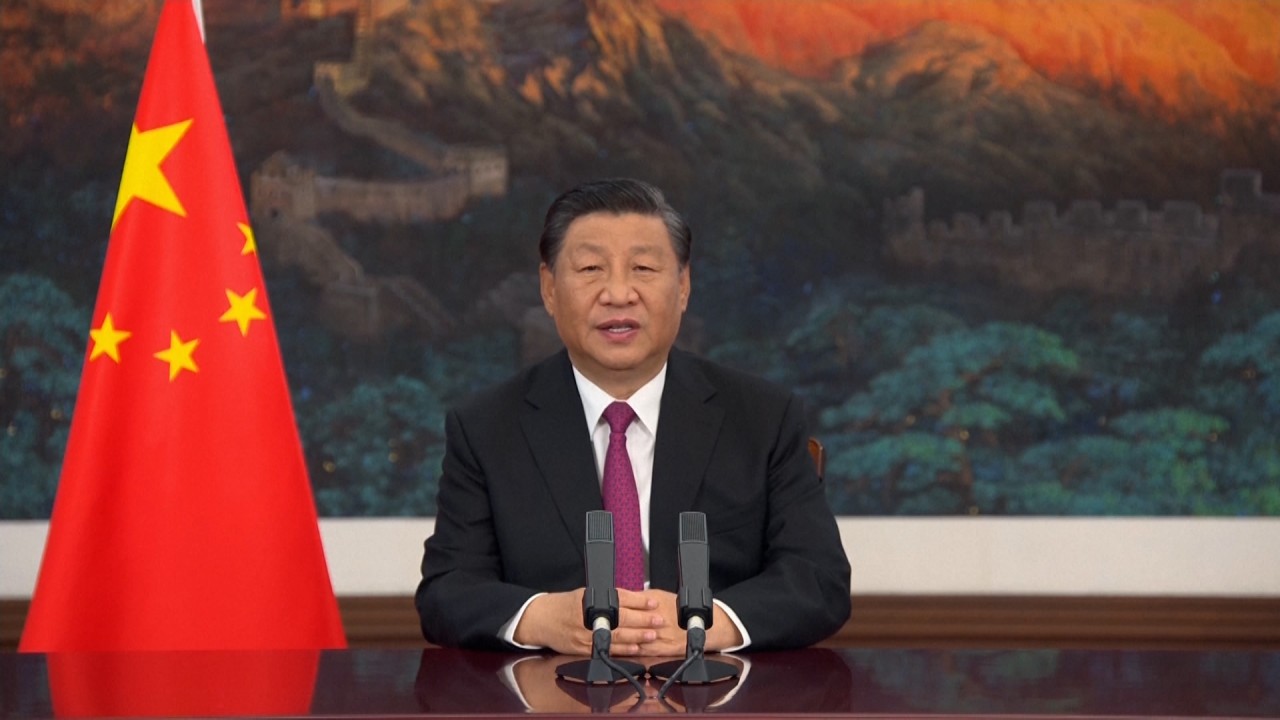

China to set up mainland’s third stock exchange in Beijing as Xi Jinping promises more digital trade zones

- Chinese President Xi Jinping tells China International Fair for Trade in Services that boosting the country’s service sector can help the post-coronavirus global recovery

- Recent moves by Beijing such as a tech crackdown and anti-sanctions law have hit investor confidence, but Xi says country ‘wants to work with all sides’

Chinese President Xi Jinping has announced plans to set up a new stock exchange in Beijing and more digital trade pilot zones under plans to expand the country’s role as a global services hub.

Service trade is an important area for international economic and trade cooperation. It plays an important role in [China’s] new development strategy

“Service trade is an important area for international economic and trade cooperation. It plays an important role in [China’s] new development strategy,” Xi said via a video link.

“We’d like to work with all sides, based on principles of cooperation and win-win, to share service trade opportunities and promote global economic recovery.”

While Xi did not elaborate on details for the mainland’s third bourse, the China Securities Regulatory Commission published an online statement after the speech that said it was “a strategic plan that will let capital markets better serve [China’s] development”.

The regulator also said all future listed companies on the exchange will be from the innovative sector already operating in the over-the-counter (OTC) market.

00:54

Xi Jinping says China to set up third stock exchange in Beijing

It would also be complementary to the two existing exchanges in Shanghai and Shenzhen, the regulator said.

The turnover of listed companies in Beijing’s OTC market grew 56.8 per cent to 129.5 billion yuan (US$20 billion) last year compared with the previous year, well below the 122.8 trillion yuan turnover in Shenzhen.

China’s Big Tech races to answer Xi’s call for ‘common prosperity’

Two of China’s vice-premiers, Han Zheng and Hu Chunhua, attended the opening of the fair, one of China’s key opportunities to woo foreign investors.

Irish Prime Minister Micheal Martin, his Vietnamese counterpart Pham Minh Chinh and several other foreign leaders attended via video-link.

Pham said in a video address that stronger collaboration in service and digital development among countries was key to the global economy.

The annual fair comes at a time when the coronavirus pandemic continues to weigh on the global and Chinese economies – with the latter expected to slowdown later this year – and tensions with Washington remain high.

Xi also said the country would launch a list of sectors where foreign investment is forbidden and promise to increase support for projects in Belt and Road Initiative countries.

The digital trade pilot zones are expected to be set up in different cities.

Commentators attending the opening of the fair told Chinese state broadcaster CCTV that although it was short, Xi’s speech was crucial for policymakers.

Regarding the establishment of the Beijing Stock Exchange, it is indeed a heavyweight policy set out to transform Beijing into the centre that services innovative small and medium-sized enterprises

Aside from signalling the importance of services as the next phase in China’s economic development, the opening of pilot trade zones and the Beijing stock exchange were a “big gift package” for the country’s capital.

“Regarding the establishment of the Beijing Stock Exchange, it is indeed a heavyweight policy set out to transform Beijing into the centre that services innovative small and medium-sized enterprises,” one unnamed analyst said.

“As many service companies and small and medium-sized enterprises have few assets, raising capital is difficult for them. This is a big problem.

“However this new system of having a third exchange would build market service for innovative small and medium-sized enterprises. I think it is also to solve the financing difficulties of our service trade enterprises in the future.”

Xi urges China to achieve 2021 economic, social goals amid Covid-19 controls

China has the world’s second largest services economy.

Services exports rose 23.2 per cent to 1.34 trillion yuan (US$207 billion) between January and July this year compared with the same period last year. In the same period, imports declined by 4 per cent to 1.47 trillion yuan, according to data released by the Ministry of Commerce on Thursday.

China’s service sector output reached 29.6 trillion (US$4.6 trillion) yuan in the first half of this year, or 55.7 per cent of gross domestic product. Last year this figure stood at 54.5 per cent.