Green bond issuance in China grows 35 per cent to record US$155 billion in 2022 as nation strives to meet climate goals

- Growth shows China’s climate commitment is increasingly integrated into its policies, says non-profit Climate Bonds Initiative

- Hong Kong can play key role in mobilising capital flows to support its own and mainland China’s carbon transition, organisation says

Green bond issuance in China grew 35 per cent last year to reach a high of US$155 billion as the country’s climate commitment became further integrated into its overall policy and economic system, according to a report by UK-based non-profit Climate Bonds Initiative (CBI) on Friday.

“China’s economic and social development have underpinned the growth of a formidable [sustainable] debt market with unique characteristics,” according to the report, jointly released by CBI, China Central Depository & Clearing Research Centre, CIB Research and Standard Chartered Bank. “This experience can support whole-economy transition by extending access to capital to entities operating in the hard-to-abate sectors.”

In 2022, China was the top source of green bonds that were aligned with the CBI’s definition and included in its database, which screens debt instruments from over 80 jurisdictions based on the non-profit’s taxonomy, allowing for comparison across markets.

China recorded US$85.4 billion of green bond offerings that met CBI’s definition last year, from both onshore and offshore issuers, followed by the US with US$64.4 billion and Germany with US$61.2 billion, according to CBI.

China’s cumulative green bond volume in CBI’s database reached US$289.6 billion at the end of 2022, coming second after the US with a total volume of US$380 billion.

Hong Kong raises US$6 billion in city’s biggest green bond offering

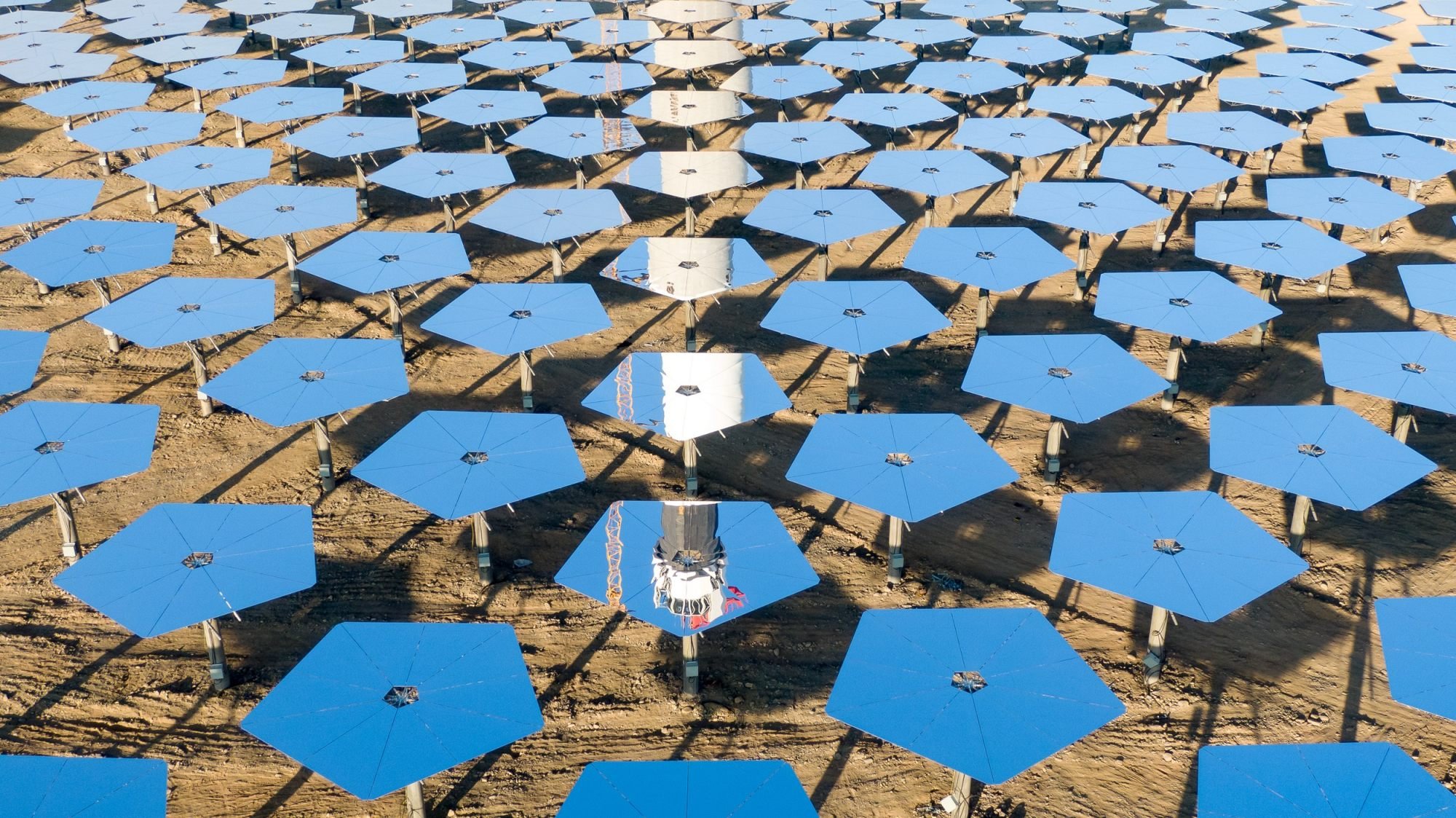

“Key strategic industry development initiatives from China, such as its hydrogen development plan, EV [electric vehicle] manufacturing and renewable energy capacity expansion, will continue to have important implications to the world,” according to the report.

“[Sustainable] debt instruments will be an important channel through which to tap into those opportunities.”

Meanwhile, Hong Kong can play an important role in mobilising the capital flow required to support both its own carbon transition and that of mainland China, according to CBI’s Hong Kong Green and Sustainable Debt Market Briefing 2022 report, also released on Friday.

Hong Kong start-up Kibo sees increased appetite for shoes made from apple waste

“The specialty for Hong Kong is that it has its own climate agenda and also serves as a green-financing platform for nearby countries and regions,” said Deng Manshu, deputy head of the China programme at CBI, speaking on a panel at the non-profit’s Climate Bonds Connect 2023 Asia-Pacific conference on Friday.

The tremendous growth of green and sustainable bonds and loans arranged in the city reflects Hong Kong’s growing importance as a regional and international hub for green and sustainable finance, according to CBI’s Hong Kong report.